The Ultimate Guide To Dubai Company Expert

Wiki Article

The 4-Minute Rule for Dubai Company Expert

Table of ContentsDubai Company Expert Fundamentals ExplainedAn Unbiased View of Dubai Company ExpertThe Best Guide To Dubai Company ExpertThe Facts About Dubai Company Expert RevealedThe smart Trick of Dubai Company Expert That Nobody is DiscussingDubai Company Expert Things To Know Before You Get ThisDubai Company Expert Things To Know Before You BuyDubai Company Expert Can Be Fun For Everyone

The web host you choose is an important factor to consider. You can have a top-notch internet site, yet it will certainly do you no great if your host has also much downtime or if the rate of surfing your site is also sluggish. Along with inspecting out evaluations on the internet, think about asking your personal as well as company network get in touches with.

Relying on the product and services you'll be offering, you will certainly additionally need to assess as well as choose your resources of supply and also stock, along with how you will supply your service or product to your client. Again, a variety of choices are available. Provided the importance of having inventory on handor a great on-demand providerand a dependable approach of satisfaction, spending ample study time on this aspect can indicate the distinction between success and also failure.

The Greatest Guide To Dubai Company Expert

The 10-year advantage duration is linked to the startup NY organization, not specific workers. Therefore, an eligible employee will just obtain ten years of the wage exemption advantage if she or he is employed prior to July 1st in the startup NY company's first year of engagement in the program and continues to be employed for the whole 10-year duration.

No, an employee employed for a net new work needs to be on the payroll for a minimum of 6 months of the schedule year at the TFA place prior to being eligible for the wage exemption advantage. He or she will be qualified for the wage exclusion benefit in the following calendar year provided he or she is utilized in the TFA for at the very least 6 months throughout that fiscal year.

Fascination About Dubai Company Expert

As long as the employee was used for at the very least six months in the fiscal year, she or he may keep the wage exclusion advantage for the year. Nevertheless, he or she will not be qualified for the benefit in subsequent years unless the business go back to conformity (Dubai Company Expert). No, a staff member is not required to stay in New york city to be eligible for the wage exemption advantage.Along with other standards, the Economic Development Law specifies a net new task as one "createdin a tax-free NY location" and "new to the state." Jobs produced according to an application accepted by ESD however not yet situated in a TFA will certainly be thought about internet brand-new jobs just under the adhering to circumstances: It is the service's initial year in the program; The work live outside the TFA into which business will certainly be locating due to the fact that no ideal room exists within such TFA; The work are moved right into the TFA within 180 days after business's application is authorized; The tasks are created after the company's application is authorized by ESD; Tax obligation advantages would certainly not begin until the organization locates to the Tax-Free Location, with the exemption of the sales tax credit rating or reimbursement.

The Best Guide To Dubai Company Expert

The companies can not report those wages as start-up NY wages until the organization situates to the Tax-Free Area. The demand for a 180-day waiver should be made at time of application submission but should be made prior to the production of any kind of internet new work subject to the waiver. A "web brand-new job" implies a task developed in a Tax-Free NY Area (TFA) that pleases all of the adhering to criteria: is brand-new to the State; has actually not been transferred from work with an additional company located in this State, via a purchase, merger, loan consolidation or other reorganization of organizations or the purchase of assets of one more company, or has actually not been transferred from work with an associated person in this State; is not loaded by a private used within the State within the promptly coming before 60 months by a relevant person; is either a permanent wage-paying task or comparable to a permanent wage-paying task calling for a minimum of 35 hrs each week; and also is filled for even more than 6 months In order to meet the six month demand, an organization should recognize the specific day when it locates to the TFA (PLACE DAY).Yes, a new work located at a TFA place that is filled up on or after the day a company is licensed to take part in the Program will certainly be counted as an internet new work for functions of satisfying its work performance objectives as long as that job continues to be filled up for at least 6 months of the 12-month duration beginning on the date that business situates to a TFA and/or six months out of each subsequent 12-month period, as well as it fulfills all the various find here other internet new task standards.

Dubai Company Expert - Questions

The net brand-new work would just be inhabited by a different individual. To establish whether a job developed by an organization taking part in the startup NY Program in a TFA can be taken into consideration a "internet brand-new job", the business has to aim to the task (not the individual) as well as the function of the work to see if it qualifies as a "net brand-new work".If an independent contractor was worked with to perform a task function for the STARTUP NY organization as well as executed the job only for the service full-time (that is, did not use these services to the general public) and also was then worked with by the company right into the very same setting doing the same work functions, the placement filled up by the independent contractor would certainly not be counted as a web new work as the setting would certainly be understood as having actually been previously been performed in the state and also hence not new.

The Ultimate Guide To Dubai Company Expert

Prior to we dive right into the information of organization enrollment, a Read Full Article please note: what we're providing here is a basic summary of the general needs for most organizations in the United States. If you operate globally or function in some niche industry like long-haul tobacco and airplane gas delivery, these standards are one hundred percent assured not to cover every little thing you require to learn about registering your company. Dubai Company Expert.

It indicates that you are the firm, as well as all properties and financial debts for the company are your own also. This also implies you'll be directly accountable for all company obligations like legal actions or debts, so this is the riskiest business framework. These are like sole proprietorships, except there's even more than one owner.

Examine This Report about Dubai Company Expert

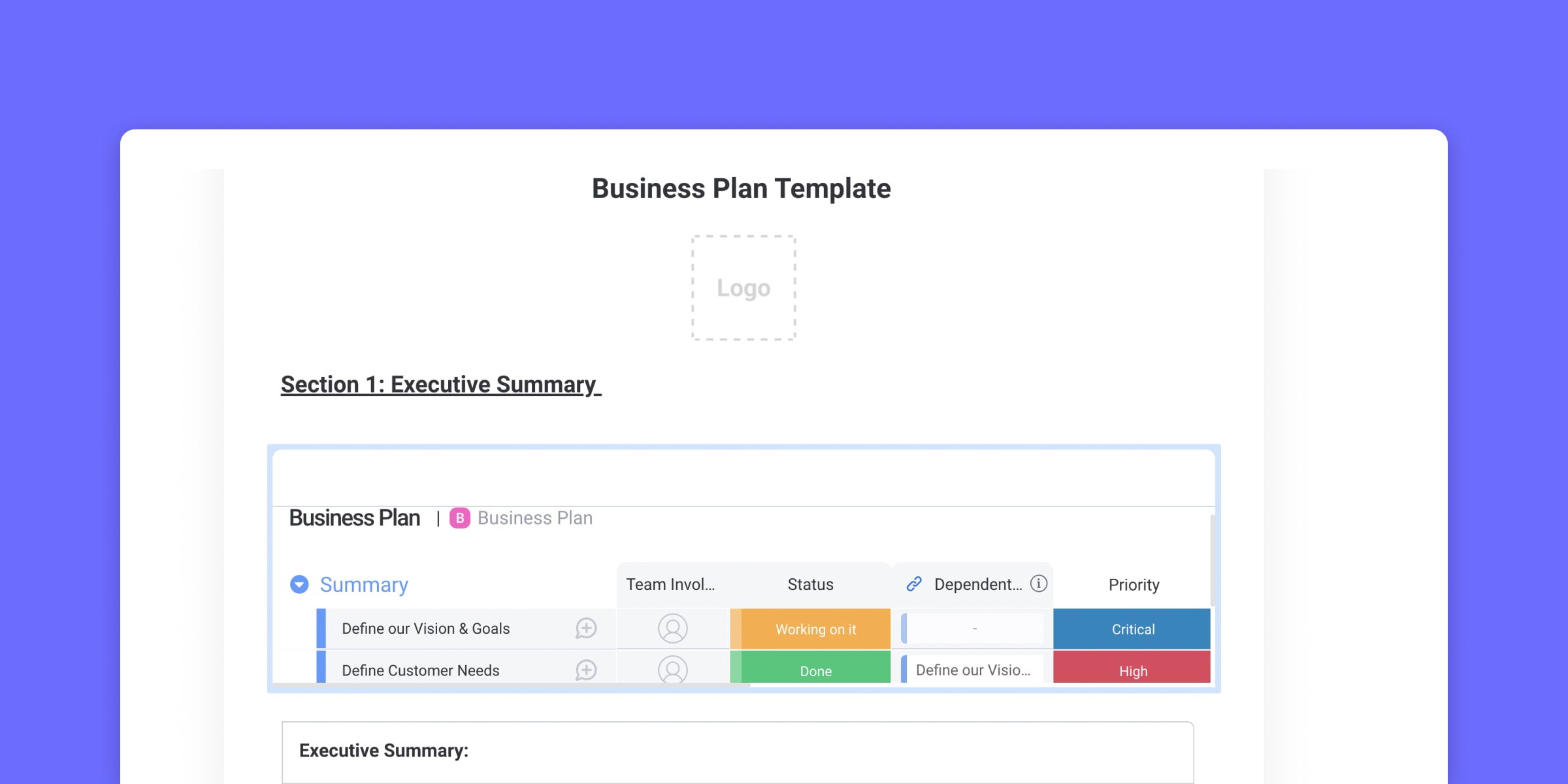

With your company plan in hand, it's time to lay the functional and financial groundwork to get your company off the ground.

The Main Principles Of Dubai Company Expert

If you sell physical items and also you operate in a helpful site state that gathers sales taxes, you likely require to register for a Sales Tax License. The majority of states administer these authorizations free of charge or for a nominal charge. Cash can obtain complicated really promptly, so you wish to have an automated system for economic audit, budgeting, and also documents prior to you begin making any kind of sales.Report this wiki page